Third Quarter 2025 Market Returns: S&P 500 Sectors & Asset Classes

In today's dynamic market, the factors driving returns are ever-changing. Our latest analysis underscores the value of a well-diversified portfolio by highlighting recent performance trends across S&P 500 sectors and asset classes. Explore the charts below to gain deeper insights into these trends and optimize your investment strategy with our expert guidance.

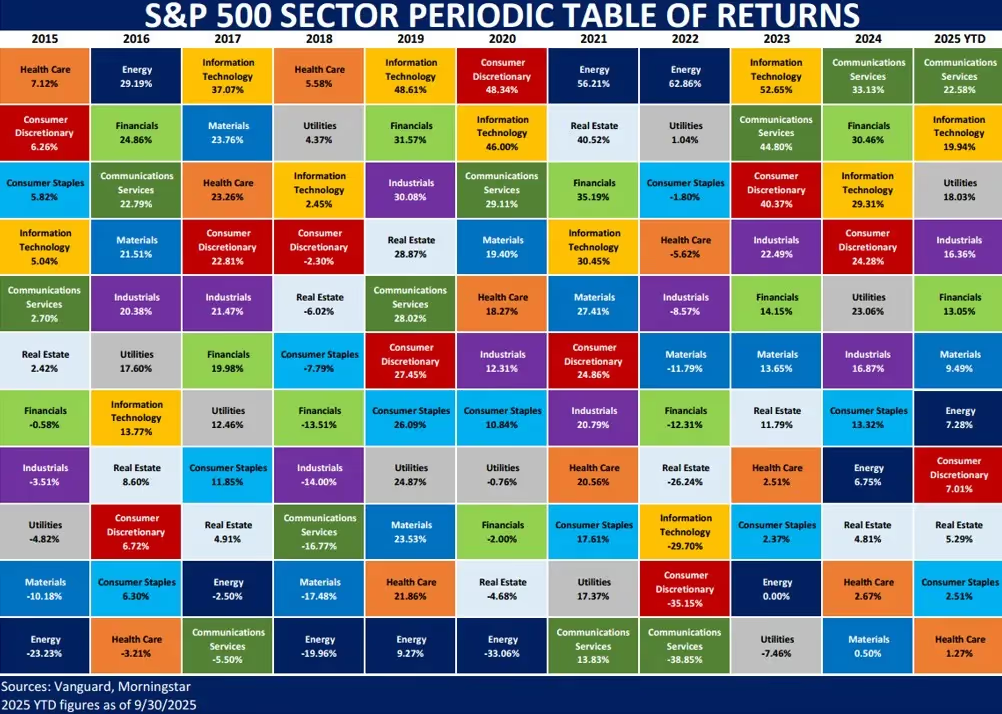

S&P 500 SECTOR PERIODIC TABLE OF RETURNS (2015 - 2025)

This chart contains the 11 sectors that constitute the S&P 500 Index. Each sector is given a unique color, and each column is organized from highest return (top) to lowest return (bottom), for a given year. The first 10 columns display annual performance for each sector from 2015 to 2024. The last column on the right illustrates year-to-date (YTD) performance, as of 9/30, for 2025.

2025 YTD Leaders:

- Communications Services = 22.58%

- Information Technology = 19.94%

- Utilities = 18.03%

2025 YTD Laggards:

- Health Care = 1.27%

- Consumer Staples = 2.51%

- Real Estate = 5.29%

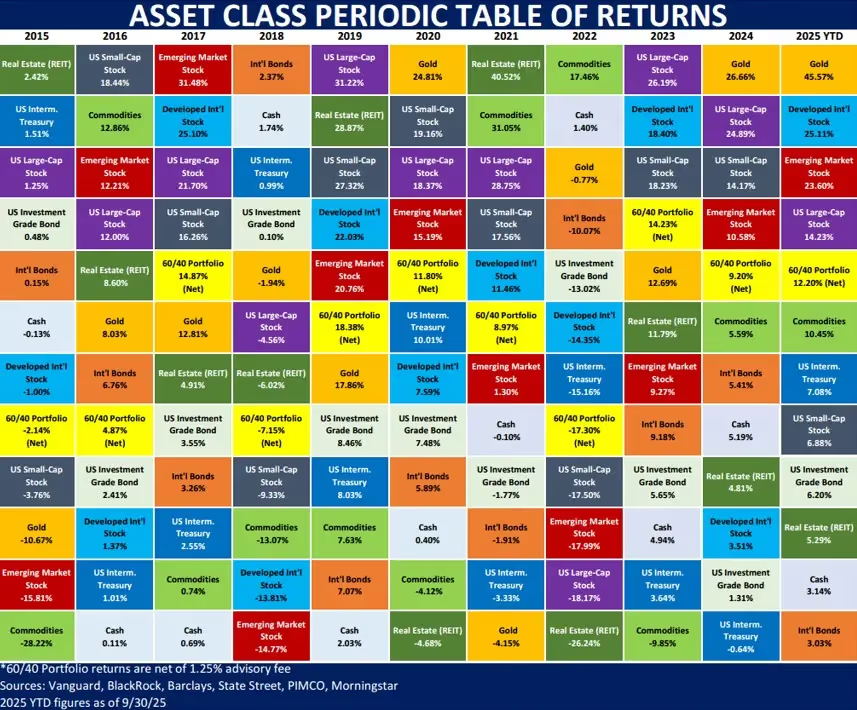

ASSET CLASS PERIODIC TABLE OF RETURNS (2015 – 2025)

This chart is composed of 11 standard asset classes and an example of a diversified 60% stock and 40% bond portfolio. Each asset class is given a unique color, and each column is organized from highest return (top) to lowest return (bottom), for a given year. The 60/40 portfolio (in bright yellow) generally falls somewhere in the middle, helping to illustrate how a diversified portfolio can reduce volatility. The first 10 columns display annual performance for each asset class from 2015 to 2024. The last column on the right illustrates year-to-date (YTD) performance, as of 9/30, for 2025.

2025 Leaders:

- Gold = 45.57%

- Developed Int’l Stock = 25.11%

- Emerging Market Stock = 23.60%

2025 Laggards:

- Int’l Bonds = 3.03%

- Cash = 3.14%

- Real Estate (REIT) = 5.29%

Please feel free to reach out to us with any questions.

In today's dynamic market, the factors driving returns are ever-changing. Our latest analysis underscores the value of a well-diversified portfolio by highlighting recent performance trends across S&P 500 sectors and asset classes. Explore the charts below to gain deeper insights into these trends and optimize your investment strategy with our expert guidance.

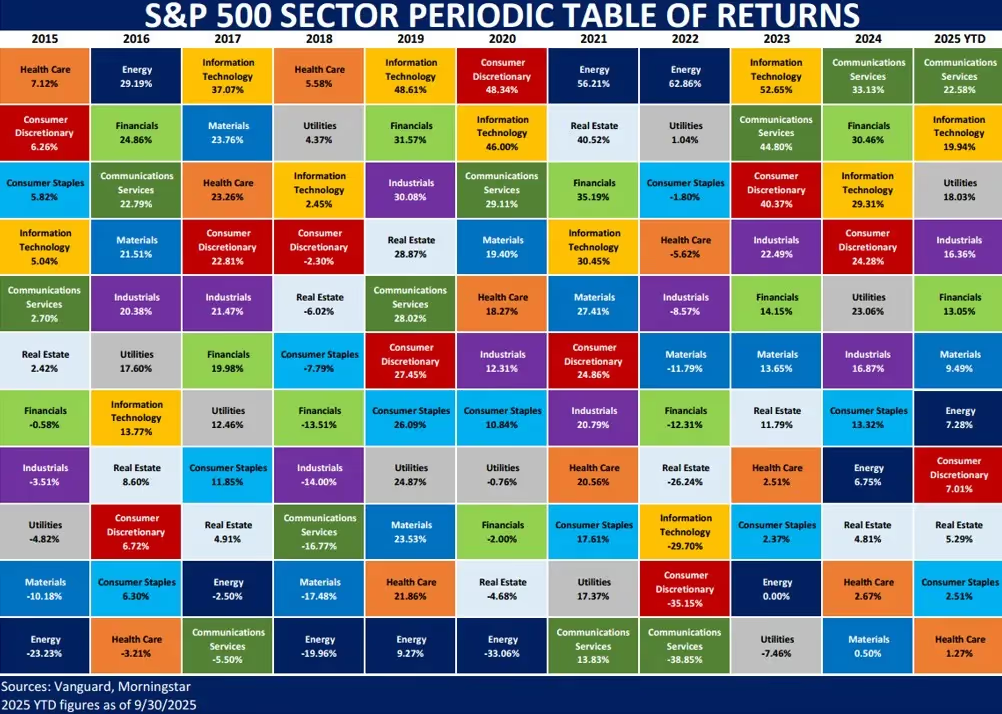

S&P 500 SECTOR PERIODIC TABLE OF RETURNS (2015 - 2025)

This chart contains the 11 sectors that constitute the S&P 500 Index. Each sector is given a unique color, and each column is organized from highest return (top) to lowest return (bottom), for a given year. The first 10 columns display annual performance for each sector from 2015 to 2024. The last column on the right illustrates year-to-date (YTD) performance, as of 9/30, for 2025.

2025 YTD Leaders:

- Communications Services = 22.58%

- Information Technology = 19.94%

- Utilities = 18.03%

2025 YTD Laggards:

- Health Care = 1.27%

- Consumer Staples = 2.51%

- Real Estate = 5.29%

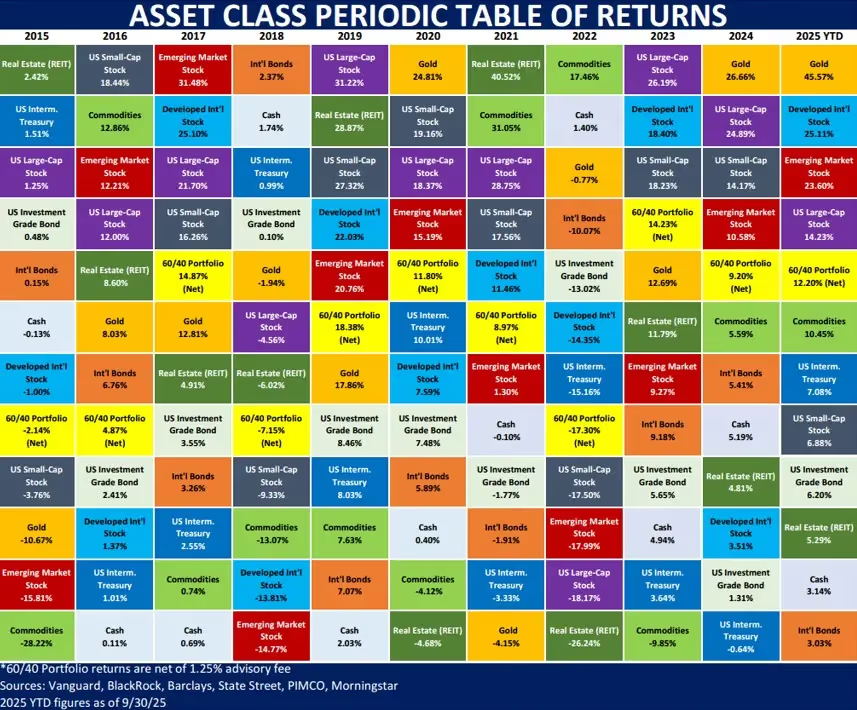

ASSET CLASS PERIODIC TABLE OF RETURNS (2015 – 2025)

This chart is composed of 11 standard asset classes and an example of a diversified 60% stock and 40% bond portfolio. Each asset class is given a unique color, and each column is organized from highest return (top) to lowest return (bottom), for a given year. The 60/40 portfolio (in bright yellow) generally falls somewhere in the middle, helping to illustrate how a diversified portfolio can reduce volatility. The first 10 columns display annual performance for each asset class from 2015 to 2024. The last column on the right illustrates year-to-date (YTD) performance, as of 9/30, for 2025.

2025 Leaders:

- Gold = 45.57%

- Developed Int’l Stock = 25.11%

- Emerging Market Stock = 23.60%

2025 Laggards:

- Int’l Bonds = 3.03%

- Cash = 3.14%

- Real Estate (REIT) = 5.29%

Please feel free to reach out to us with any questions.

.avif)