|

KEY TAKEAWAYS

|

Over the past decade, U.S. markets have generally outperformed international markets, leading many to question the need to maintain international diversification in their portfolios. However, diversification remains a core tenet of The Mather Group’s (TMG) portfolio construction for a number of reasons. In this article, we will walk through what diversification means, how it can ultimately lead to better long-term outcomes, and how we implement diversification within TMG’s portfolios.

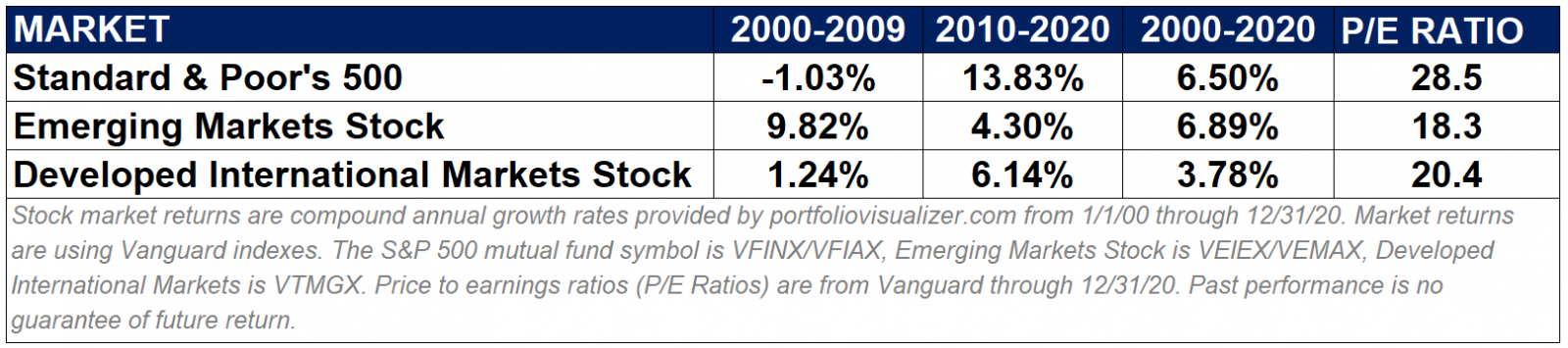

As we review our portfolio allocations, TMG is specifically looking at the long-term relationship between different asset classes. Investors should not expect the same sectors to continuously outperform the rest. For example, while the U.S. market outperformed international markets in the 2010s, the S&P 500 provided a negative return in the 2000s,1 while international markets provided the source of return. The chart below appeared in TMG’s 4th quarter market update to illustrate this fact:

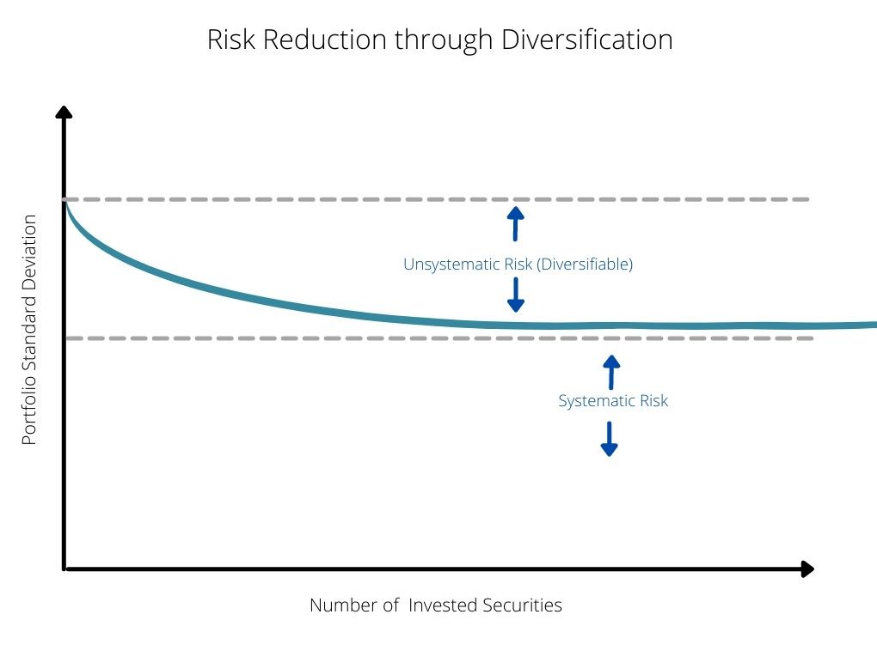

Diversification works by spreading a portfolio’s risk across different asset classes to ensure that investments are not overexposed to any single risk factor. Modern Portfolio Theory (MPT) describes the benefits of diversifying by breaking up total portfolio risk into two buckets:

Systematic risk: The risk inherent to investment in the market. This is the risk that investors must accept in order to invest in markets.

Unsystematic risk: The risk from an investment in a single security. This risk can be materially reduced by holding non-correlated investments in many individual companies or asset classes. Correlation measures how closely two assets move together in the market. Holding non-correlated assets that react differently to market conditions offsets unsystematic risk.

Systematic risk is effectively unavoidable for investors, as some amount of risk must be taken when investing. However, unsystematic risk can be mitigated in the portfolio through diversification, as not all investments have the same risk exposures. As an example, a concentrated single-stock portfolio that invests only in a major oil firm will have its performance greatly impacted by the price of oil. On the other hand, a diversified portfolio that holds only a small portion of its holdings in oil firms is not only much less exposed to a shock in oil prices but may hold other investments that benefit from lower commodity prices, such as airlines. By adding more securities that have a low or negative correlation to the existing portfolio, volatility can be reduced, resulting in smoother market returns. By diversifying away the majority of the unsystematic risk in a portfolio, investors are left with a more efficient portfolio in terms of expected risk vs. return.

Source: Investopedia

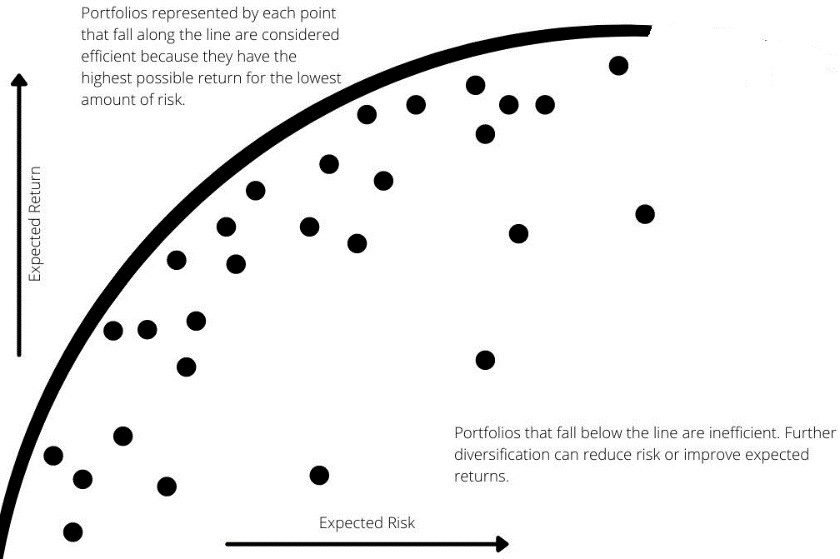

A portfolio is considered inefficient if it is possible to attain the same performance with less risk (or greater performance for the same risk). By plotting risk, return, and correlation expectations for various asset classes, it is possible to construct an appropriate portfolio for any given risk level. This concept is illustrated through the efficient frontier. A portfolio that falls along the efficient frontier is considered to be efficient (or maximizes the reward for a given level of risk). Any portfolio that falls below the efficient frontier is considered inefficient. In other words, there is still unsystematic risk remaining in an inefficient portfolio that could be offset with further diversification.

Source: InvestingAnswers.com

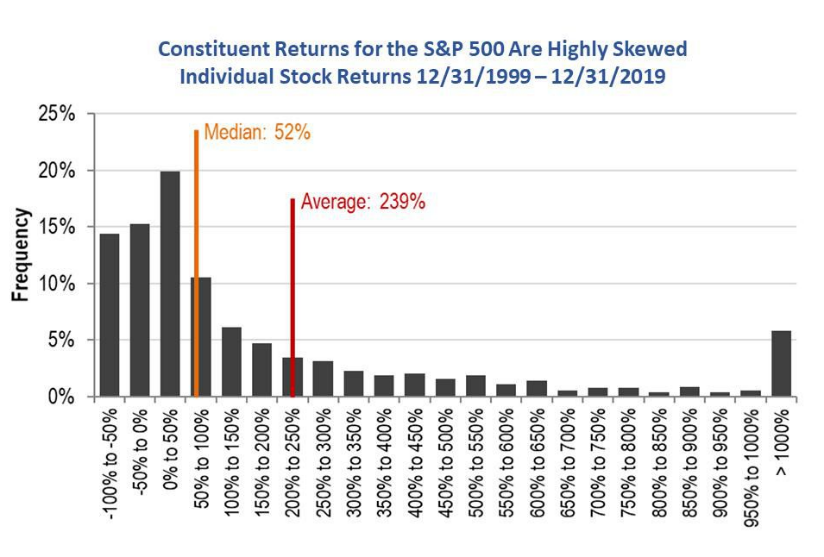

Concentrated stock holdings are a common source of unsystematic risk as stock performance tends to be positively skewed, meaning the performance of the market as a whole is driven by a relatively small number of stocks. For the 20-year-period between 2000-2019, S&P found that the average return of the S&P 500 was 6.29% per year; however, only 26% of the stocks within the index outperformed the average.2 The index primarily consists of underperforming securities, and undiversified portfolios may omit the top performing stocks. As a result, concentrated stock holdings are likely to lead to market underperformance, if they do not contain the handful of stocks which drive performance. 3

Source: S&P

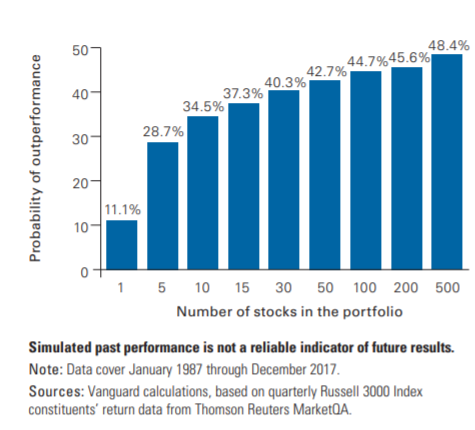

Similarly, Vanguard researched the effects of investing in concentrated portfolios and its impact on expected returns. Since most stocks underperform the benchmark, Vanguard found that increasing the number of holdings in a portfolio increased the odds of outperforming or matching the benchmark.4 Specifically, Vanguard found that broadly diversified portfolios increase the odds of benchmark outperformance, reduce tracking error (the difference in performance between a portfolio and its benchmark), and narrow the dispersion of potential return outcomes.

TMG believes an excellent way to add uncorrelated positions and build portfolios is through tax-efficient, low-cost index funds. Index funds help diversify risk by holding a variety of securities within the fund. By holding index funds that invest across different world markets, the risk is further mitigated, creating a well-diversified portfolio for our clients. TMG goes a step further by rebalancing client portfolios as needed, not just on a set schedule such as quarterly or annually. When portfolios drift out of a specific target range, the team at TMG rebalances the appropriate positions to bring them back in line with the portfolio strategy, therefore keeping the risk tolerance in check. This is a crucial step in ensuring that diversification remains intact.

1Investing In International Equities, Fidelity, 2016.

2Why Its So Hard to Beat the Market, Forbes, August 2020.

3The Slings and Arrows of Passive Fortune, Standard & Poor’s, March 2018.

4How to Increase the Odds of Owning the Few Stocks That Drive Returns, Vanguard, February 2019.

The Mather Group (TMG) is registered under the Investment Advisers Act of 1940 as a Registered Investment Adviser with the Securities and Exchange Commission (SEC). Registration as an investment adviser does not imply a certain level of skill or training. The opinions expressed, and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. The opinions and advice expressed in this communication are based on TMG’s research and professional experience and are expressed as of the publishing date of this communication. All return figures shown are for illustrative purposes only. TMG makes no warranty or representation, express or implied, nor does TMG accept any liability, with respect to the information and data set forth herein. TMG specifically disclaims any duty to update any of the information and data contained in this communication. The information and data in this communication does not constitute legal, tax, accounting, investment, or other professional advice nor is it intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives. Past performance does not guarantee future results . For a detailed discussion of TMG and its investment advisory services and fees, please see the firm’s Form ADV on file with the SEC at www.adviserinfo.sec.gov.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. S&P (Standard & Poor’s) 500 - is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. VFIAX - seeks to track the performance of its benchmark index, the S&P 500. Fund attempts to replicate the target index by investing all of its assets in the stocks that make up the Index with the same approximate weightings as the Index. VFINX - seeks to track the performance of its benchmark index, the S&P 500. The Fund attempts to replicate the target index by investing all of its assets in the stocks that make up the Index with the same approximate weightings as the Index. VEIEX - seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries. The Fund employs an indexing investment approach designed to track the FTSE Emerging Markets All Cap China A Inclusion Index by sampling the Index. VEMAX - seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries. VTMGX – provides investors low-cost, diversified exposure to large-, mid-, and small-capitalization companies in developed markets outside of the United States. Please contact TMG for additional information on any indices mentioned in this article.